The Ultimate Guide to Tax Credits and Reliefs in Ireland

In Ireland, navigating tax credits and reliefs can be complex, yet these benefits are crucial for reducing tax liabilities and maximizing refunds. This guide covers essential credits and reliefs available to individuals, families, and business owners, from the Earned Income Tax Credit to health expenses relief. By understanding these credits and using them effectively, you can potentially save significantly on your taxes.

Whether you’re an employee, self-employed, or supporting dependents, it’s important to familiarize yourself with the options available to you. Remember, every credit or relief you claim can lead to substantial savings, leaving you with more disposable income to invest in your future or enjoy with your family.

To begin, take stock of your current situation and identify which credits you are already claiming. Then, explore additional options that might apply to your circumstances. If you find the process daunting, consider seeking professional advice. Tax experts like us at TaxReturned.ie can provide valuable insights into lesser-known credits and ensure that you’re fully compliant with all regulations.

If you don’t want any tax professional on board then technology can be your ally in managing your tax affairs. Online platforms like Revenue’s myAccount offer user-friendly interfaces to help you claim your entitlements efficiently. By keeping organized and informed, you’ll not only ensure compliance but also optimize your financial health.

Remember, the landscape of tax credits and reliefs can change annually, so staying updated on the latest information is vital. With the right knowledge and tools, you can confidently navigate the system and make the most of the opportunities available to you.

What Are Tax Credits and Reliefs?

Understanding tax credits and reliefs is essential for effective tax planning and ensuring you’re not paying more than necessary. Here’s a closer look at how these financial tools can benefit you:

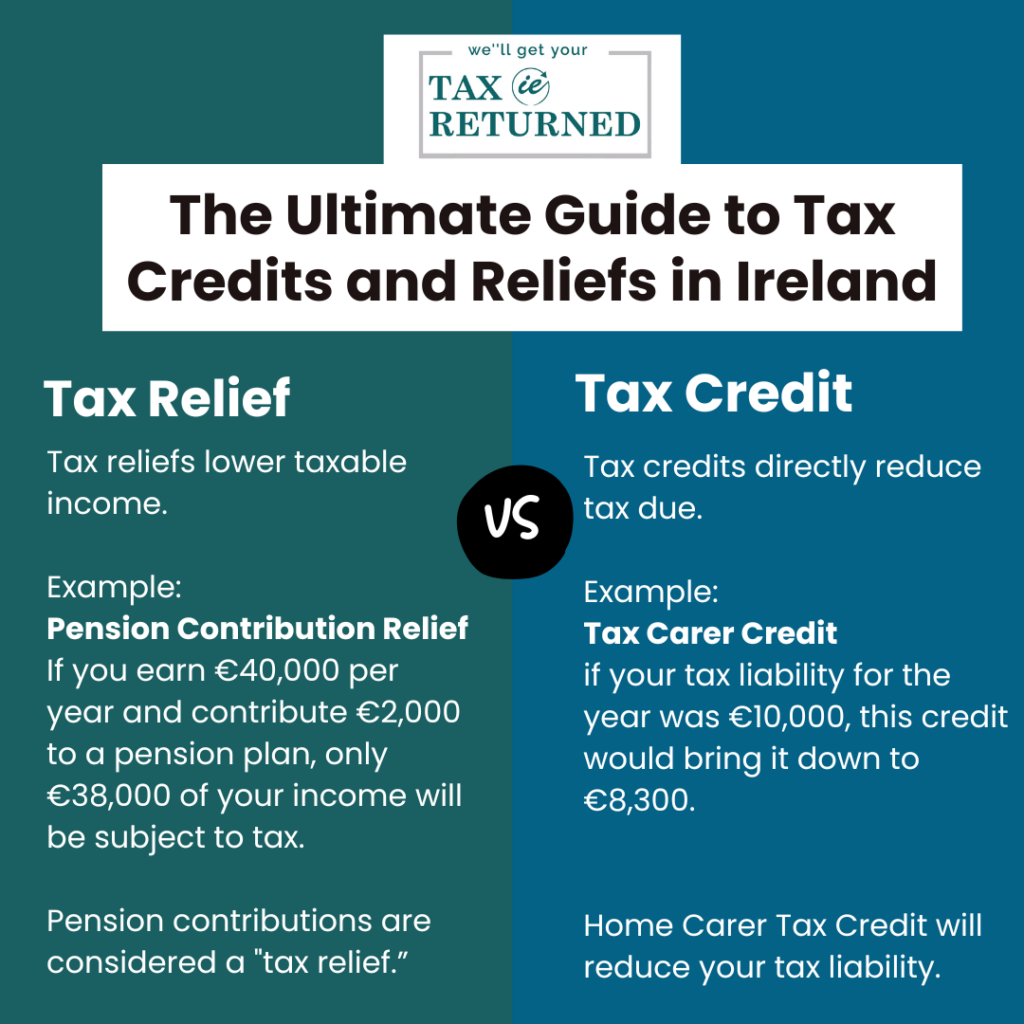

The Impact of Tax Credits:

Tax credits are particularly beneficial because they directly decrease your tax liability. For instance, if you owe €5,000 in taxes and have €2,000 in tax credits, your tax bill is reduced to €3,000. This straightforward reduction means more money remains in your pocket. Common tax credits include the Employee Tax Credit and Personal Tax Credit, which automatically reduce your tax bill.

The Role of Tax Reliefs:

Tax reliefs work a bit differently by lowering the amount of your income that is subject to tax. For example, if you have an income of €50,000 and claim €5,000 in tax reliefs, only €45,000 of your income is taxed. This can result in substantial savings, especially if you are in a higher tax bracket. Reliefs can be claimed on pension contributions, health expenses, and rental payments, among others.

By strategically using both tax credits and reliefs, you can significantly lower your tax burden. It’s important to familiarize yourself with the specific credits and reliefs applicable to your situation to make the most of these opportunities. Always ensure to maintain accurate records and documentation to support your claims, and consider consulting with a tax professional if you’re unsure about the process.

Step 1: Identify Key Tax Credits Available to You

Begin by assessing your individual circumstances to determine which tax credits you may be eligible for. Here’s a brief overview of some key tax credits:

- Employee Tax Credit: Available to PAYE employees, this credit reduces taxable income. Currently set at €1,775, it’s one of the most commonly used credits.

Earned Income Tax Credit: Designed for self-employed individuals and proprietary directors, it’s an alternative to the PAYE credit, with a maximum value of €1,875.

Home Carer Tax Credit: For individuals who care for dependents, this credit provides relief of up to €1,700 if you’re eligible.

Dependent Relative Tax Credit: For individuals who financially support a relative, this offers a credit of €245.

Blind Person’s Tax Credit:

If you or your spouse is visually impaired, you may be eligible for this credit, which provides financial support to assist with additional expenses. The credit is currently valued at €1,650.Widowed Parent Tax Credit:

This credit is available to widowed individuals who have dependent children. It starts at €3,600 for the first year after bereavement and decreases over the following years.Age Tax Credit:

Available to individuals aged 65 and over, this credit provides financial relief in recognition of the additional costs associated with aging. The current value is €245 for single individuals or €490 for married couples.

Understanding these key tax credits can help you effectively manage your tax liabilities and ensure you are taking advantage of every possible benefit. Always verify your eligibility and consult with a tax professional if you have any doubts about your specific situation. Taking the time to understand and claim these credits can lead to significant savings and a more secure financial future.

Step 2: Explore Additional Reliefs and How to Claim Them.

Beyond the basic tax credits, there are numerous reliefs available that can further reduce your tax liabilities. Understanding these reliefs and knowing how to claim them can lead to significant savings.

- Medical Expense Relief:

You can claim 20% relief on qualifying medical expenses, including those for prescriptions, specialist treatments, and some dental expenses. It’s essential to keep all receipts and submit your claims through the Revenue’s myAccount service to ensure accuracy and efficiency.

- Tuition Fees Relief:

If you or a dependent is attending a third-level educational institution, you may qualify for relief on tuition fees. This relief applies to fees exceeding €3,000, making higher education more affordable.

- Rent Tax Credit (Reintroduced):

For renters, this credit provides relief of €500 for single individuals and €1,000 for couples. It’s a welcome return for those renting in the competitive housing market, offering a way to alleviate some of the financial pressure.

- Pension Contributions:

Contributions to an approved pension scheme are tax-deductible. This not only reduces your current taxable income but also helps secure your financial future by encouraging savings for retirement.

- Home Renovation Incentive:

This relief allows homeowners to claim a tax credit on the cost of home improvements. If you’re planning renovations, this can be a valuable way to offset expenses while enhancing your property value.

By exploring these additional reliefs and understanding how to effectively claim them, you can optimize your tax strategy and keep more of your income for the things that matter most to you. If you need any help at any step of the way, TaxReturned.ie is the best solution for all your tax woes.

Step 3: How to Claim Your Credits and Reliefs

Using myAccount on Revenue.ie: Log in and navigate to the relevant forms for each credit or relief. You can claim some credits directly when filing your annual tax return, while others, like the Home Carer Credit, may require additional documentation.

- Submitting Form 11 for Self-Assessed Taxpayers: Self-employed individuals can use Form 11 to claim multiple credits at once, including the Earned Income Credit and pension relief. Click here to sign up for Form 11 and ease your tax woes.

- Keep Accurate Records: Maintaining thorough documentation is crucial. Ensure you have all necessary receipts and paperwork to substantiate your claims, especially for medical and tuition fee reliefs. This preparation will facilitate a smoother process when filing and help you avoid any potential issues with verification.

- Verify Eligibility Criteria: Before claiming, double-check the specific eligibility requirements for each credit and relief to ensure you qualify. This step prevents any unexpected denials and ensures you are accurately benefiting from available tax provisions.

- Consult with a Tax Professional: If you’re uncertain about the process or want to ensure you’re optimizing your claims, seeking advice from a tax professional can be invaluable. They can provide personalized guidance, helping you navigate the complexities with ease and confidence. We, at TaxReturned.ie will provide fast, efficient, and accurate tax filing support tailored to your needs.

By following these steps, you can effectively claim the tax credits and reliefs you’re entitled to, ultimately reducing your tax liabilities and enhancing your financial well-being. Stay proactive, informed, and organized to make the most of your tax opportunities.

Step 4: Common Mistakes to Avoid

Claiming tax credits and reliefs can lead to significant savings on your tax bill, but to fully benefit, it’s important to avoid common pitfalls. In this guide, we’ll cover the steps to maximize your claims, along with key mistakes to watch out for, helping you navigate the process with confidence and accuracy. Some of the common mistakes to avoid are:

Not Keeping Documentation: Ensure you retain receipts for any expenses claimed, especially for health expenses or educational costs.

Missing Deadlines: Credits can typically be claimed up to four years retroactively, but it’s best to claim within the tax year for the best refund outcomes.

Overlooking Eligibility Changes: Check if there are annual updates to credit amounts or eligibility requirements as these can impact your claim.

Incorrectly Calculating Reliefs: Make sure you accurately calculate the amounts you are eligible to claim. Miscalculations can lead to delays or denials of your claims. Using online calculators or consulting a tax professional can help ensure accuracy.

Relying Solely on Automation: While technology can simplify the process, it’s crucial to manually verify the information before submission. Automated systems may not catch every nuance of your personal situation, so a careful review is always beneficial.

Neglecting to Update Personal Information: Changes in your personal circumstances, such as a new job, marriage, or dependents, can affect your eligibility for certain credits and reliefs. Update your details promptly to ensure you receive the appropriate benefits.

Assuming All Credits Apply: Not every credit or relief is applicable to everyone. Research thoroughly to understand which ones are relevant to your situation, and avoid claiming those for which you don’t qualify, as this can lead to issues with the Revenue Commissioners.

By being mindful of these common pitfalls, you can streamline your tax filing process, avoid unnecessary complications, and maximize your potential tax benefits. Taking a proactive approach and double-checking every detail will set you up for success in managing your taxes efficiently.

Step 5: How TaxReturned.ie Can Help You

Navigating tax credits and reliefs can be overwhelming, but the potential savings make it well worth the effort. By ensuring you claim all eligible credits, you can significantly reduce your tax burden. However, the process can be complex and time-consuming, especially with ever-evolving tax rules and requirements. That’s where TaxReturned.ie comes in. Our team of certified tax experts is dedicated to identifying all applicable credits and reliefs for you, handling the paperwork, and liaising directly with the Revenue Commissioners to make the process as smooth as possible. With our support, you can rest assured that you’re maximizing your refund without unnecessary stress. Ready to take control of your tax benefits? Start with a free consultation at www.taxreturned.ie and let us help you get the refund you deserve.

Case Study: Maximizing Tax Relief and Credits for a Freelance Graphic Designer in Ireland

Background:

Sarah, a freelance graphic designer based in Dublin, struggled with tax compliance and often found the self-assessment tax filing process overwhelming. With various allowable expenses like equipment purchases, software subscriptions, and home office deductions, she knew there were reliefs and credits she could claim but wasn’t certain which ones applied. She had also recently undertaken a short-term design course to upskill, but wasn’t aware it could qualify for an educational tax relief.

Challenges:

Sarah’s main issues were:

Lack of clarity on what expenses were deductible.

Unawareness of tax credits she was eligible for, like the Tuition Fee Relief for her design course.

Difficulty navigating the Revenue system to submit claims correctly, which led to missed opportunities for maximizing her refund.

Solution with TaxReturned.ie:

Sarah reached out to TaxReturned.ie, who offered her a free consultation. Their tax experts helped identify several areas where she could claim additional reliefs:

Home Office Relief – TaxReturned.ie guided Sarah in calculating the allowable portion of her rent, electricity, and internet costs for her home office setup.

Tuition Fee Credit – They assisted her in claiming relief on her recent design course, qualifying her for a tax credit based on the course cost.

Professional Equipment and Software Deductions – TaxReturned.ie highlighted expenses she could deduct for software subscriptions, graphic design tools, and equipment purchases.

After handling the paperwork and submitting claims through the Revenue’s system on Sarah’s behalf, TaxReturned.ie ensured everything was filed accurately and on time. They provided guidance on keeping documentation organized for future claims and reminded her of the eligibility rules and deadlines for specific credits.

Outcome:

With TaxReturned.ie’s support, Sarah received a 15% higher refund than she expected, saving her both time and effort. She now has a clear understanding of the reliefs available to her as a self-employed professional and continues to work with TaxReturned.ie for ongoing tax support.

Conclusion:

Navigating tax credits and reliefs can be complex, but as Sarah’s case shows, working with a knowledgeable team like TaxReturned.ie can lead to significant savings. For freelancers, small business owners, and individuals alike, TaxReturned.ie provides the expertise to maximize refunds without the hassle. Ready to uncover your potential tax savings? Start with a free consultation at www.taxreturned.ie