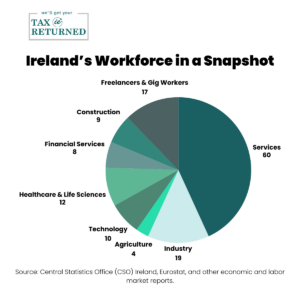

With the rise of remote work and flexible gigs, more people in Ireland are joining the freelancer and gig economy workforce. According to recent data, over 17% of Ireland’s workforce is self-employed, and the gig economy has grown rapidly in recent years. Freelancers and gig workers enjoy flexibility and control over their schedules, but this also comes with the complexity of managing taxes independently. Navigating Ireland’s tax landscape is crucial to remain compliant and take full advantage of deductions and credits. This comprehensive guide offers essential tax tips to make the process manageable and beneficial for freelancers and gig workers across Ireland.

1. Register for Self-Assessment with Revenue

As a freelancer, you must handle your own tax responsibilities, which start with registering for self-assessment. This ensures you’re compliant with Revenue’s requirements and prepared to pay income tax, PRSI (Pay Related Social Insurance), and the Universal Social Charge (USC).

- How to Register:

You can register online through Revenue’s Online Service (ROS). The process involves submitting a TR1 form for sole traders or completing the ROS registration process directly. - Why It Matters:

Early registration avoids late penalties and ensures you have time to gather and prepare the documents needed for your tax return.

2. Maintain Accurate and Comprehensive Records

Freelancers must maintain organized records of all income and expenses. Accurate record-keeping is essential for calculating taxable income, claiming deductions, and preparing for potential audits.

- What to Track:

- Income from clients, gig platforms, and other sources.

- Business-related expenses, such as office supplies, software, travel expenses, and marketing costs.

- Receipts for deductible expenses, including health and professional services.

- Best Practices:

- Use dedicated accounting software to track and categorize income and expenses automatically.

- Store digital copies of receipts to reduce paperwork clutter and prevent loss.

3. Know Which Expenses Are Deductible

Freelancers can claim tax deductions on expenses that are “wholly and exclusively” related to their work. Deductions lower your taxable income, which in turn reduces your tax bill.

Common Deductible Expenses Include:

- Home Office Costs:

If you work from home, you can claim a portion of your rent, utilities, broadband, and other related expenses as business costs. Calculate this based on the square footage of your work area versus your total living space. - Travel Expenses:

If you travel for business (e.g., client meetings), keep records of transport costs, accommodation, and meals. - Professional Fees and Subscriptions:

Costs related to professional development, memberships, and subscriptions relevant to your business are deductible. - Office Supplies and Equipment:

Expenses for office supplies, electronics, software, and more used in the course of your business qualify for deductions.

Quick Tip: Only claim what is genuinely work-related. Over-claiming can lead to penalties.

4. File and Pay Taxes on Time

Freelancers in Ireland are required to file their taxes annually by October 31st. However, if you use Revenue’s Online Service (ROS), you may have an extension until mid-November.

Filing Deadlines and Guidelines:

- Preliminary Tax Payment:

Freelancers must pay preliminary tax, which is an estimate of your tax liability for the current year. Failure to do so can result in penalties. - Tax Filing Timeline Tips:

- Start preparing early to avoid a last-minute rush.

- Use online tools or work with a tax professional to ensure accurate filing.

5. Make PRSI Contributions

All freelancers must pay PRSI (Pay Related Social Insurance) contributions. This covers you for social benefits, such as pensions, illness benefit, and other entitlements.

- PRSI Class S:

Freelancers pay Class S contributions, which are charged at 4% of your total income (subject to a minimum annual contribution).

Quick Tip: Ensure you understand your entitlements and what PRSI covers you for as a self-employed worker.

6. Take Advantage of Tax Credits and Reliefs

Freelancers should explore tax credits and reliefs to maximize tax savings. Common credits include:

- Earned Income Tax Credit:

A credit available to self-employed individuals, currently worth up to €1,775 per year. - Home Carer’s Tax Credit (if applicable):

Available to those caring for a dependent person. - Pension Contributions:

Contributing to a private pension can reduce taxable income and offer tax relief at the marginal rate.

7. Separate Business and Personal Finances

Keeping your business and personal finances separate is crucial for accurate accounting and tax filing.

Tips for Managing Finances:

- Open a Dedicated Bank Account:

This makes it easier to track income and expenses related solely to your freelance work. - Create a Budget for Taxes:

Set aside a percentage of each payment you receive to cover taxes, USC, and PRSI.

8. Stay Up-to-Date with Tax Regulations

Tax regulations in Ireland are subject to change, and as a freelancer, you need to stay informed to remain compliant.

- Subscribe to Updates:

Follow Revenue’s announcements, and consider joining freelancer communities for updates on tax policies and tips. - Consult a Tax Professional:

Seek advice from experts like TaxReturned.ie to ensure you maximize your entitlements and comply with the latest tax laws.

9. Seek Expert Tax Assistance

Navigating self-employment taxes alone can be challenging. Enlisting the help of tax professionals can save time, ensure compliance, and potentially maximize your refund.

- Why Choose TaxReturned.ie?

- Certified tax experts familiar with freelancer needs.

- Help with identifying deductible expenses.

- Liaison with Revenue on your behalf.

Contact TaxReturned.ie today to simplify your tax filing process and maximize your refund.

Conclusion

Freelancers and gig economy workers in Ireland have unique tax obligations, but with the right strategies, you can optimize tax savings and avoid unnecessary stress. Whether it’s understanding deductible expenses, filing taxes on time, or leveraging tax reliefs, these tips ensure you remain compliant and maximize your earnings. If you need help, TaxReturned.ie offers expert guidance to make tax filing fast, easy, and stress-free. Get started with a free consultation today!